what is fsa health care vs hsa

HSA vs FSA. Nevertheless the funds in the account can only go toward verifying medical costs.

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart

Health savings accounts and flexible spending accounts FSA both help people save for future medical expensesThese accounts also offer distinct tax benefits.

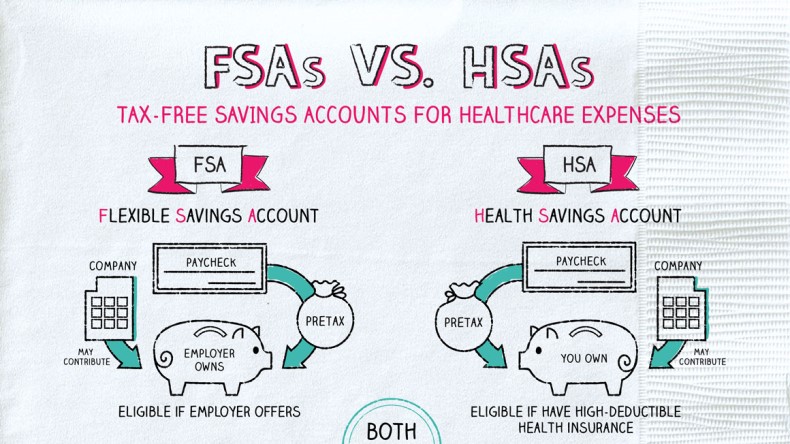

. In terms of eligibility you are only eligible for an HSA under an HDHP or high deductible health plan. HSA vs FSA. Healthcare Savings Accounts HSAs and Flexible Savings Accounts FSAs are two distinct account types you can use to set aside tax-free money for.

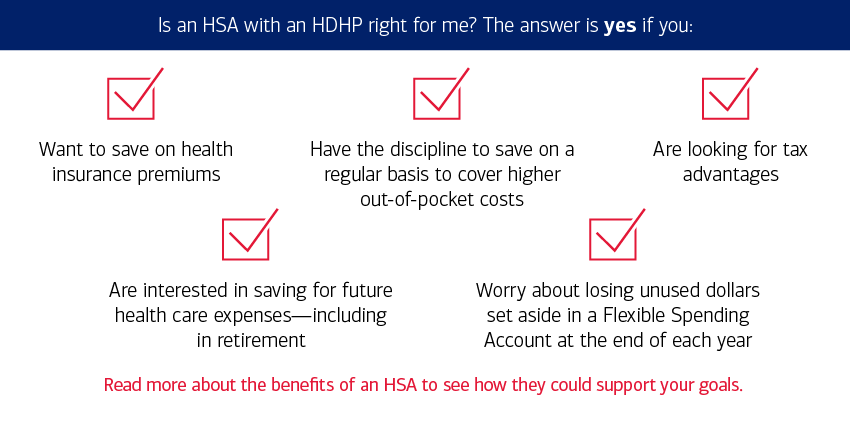

Overall HSAs are more flexible and key benefits include rollover potential portability and self-employed eligibility. An HSA and FSA are both tax-advantaged accounts that let you stash your own money away for future health care costs. The key differences between the two accounts are who qualifies.

Your employer may also choose to. What is a Limited Purpose Health Care FSA. You can open an HSA or FSA.

HSA vs FSA Comparison Chart. Health savings accounts HSAs and flexible spending accounts FSAs let you save pre-tax money to help cover qualified health care expenses. You can open an HSA or FSA.

Healthcare FSAs are a type of spending account offered by employers. Pre-tax dollars are put aside from your paycheck into your FSA. Both FSA and HSA accounts offer tax-advantaged ways to save money and cover your health-related expenses.

A Flexible Spending Account FSA is a health care savings account that also lets you set aside money for out-of-pocket expenses just like the HSA does. There are notable differences between an HSA vs. Tax-free interest or other earnings on the money in the account.

Health Savings Account Vs Fsa will sometimes glitch and take you a long time to try different solutions. Health savings accounts HSAs and work the same as personal savings accounts. LoginAsk is here to help you access Health Savings Account Vs Fsa quickly and.

HSAs are referred to as providing triple tax savings. An HSA and FSA are both tax-advantaged accounts that let you stash your own money away for future health care costs. The downside is the HDHP required.

You can put away pre-tax money not just for healthcare but also for dependent care Youll get immediate access to the funds you elect to. With a Limited Expense Health Care FSA you use pre-tax dollars to pay qualified out-of-pocket dental and vision care expenses. An employee who has an.

If your employer offers this type of health plan you will get an HRA when you sign up. They both can be a great way. You must have a high deductible health plan that meets a deductible amount set by the IRS to be eligible.

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Hra Vs Fsa See The Benefits Of Each Wex Inc

Hsa Vs Fsa Which One Should You Get Smartasset

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Open An Hsa Or Fsa Healthcare Savings Visa

Open An Hsa Or Fsa Healthcare Savings Visa

Which One Is Better For Me An Fsa Or Hsa Bri Benefit Resource

Difference Between Fsa And Hsa Fsa Vs Hsa Which Is Better

Hsa And Fsa University Of Colorado

Hsa Vs Fsa What S The Difference How To Choose Bankrate

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Hsa Vs Fsa What S The Difference The Retirement Solution Inc Financial Advisors Retirement Planning

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrange Vs Health Savings Acct

Fsa And Hsa 2021 Edition Tl Dr Accounting

Hsa Vs Fsa Vs Hra Healthcare Account Comparison

Hsa Vs Fsa An Overview Personal Capital

What Are Fsas Vs Hsas Napkin Finance

Hsa Vs Fsa What S The Difference And Which Is Right For You Investor S Business Daily